Imagine shaving off months or even years from your auto loan term while saving hundreds or thousands in interest payments. Sounds empowering, doesn’t it? Whether you’re tired of monthly payments or want to free up cash flow, understanding how to use an auto loan early payoff calculator can transform your financial journey.

This article will walk you through everything you need to know about early loan payoff, from the benefits and potential savings to actionable tips for accelerating your progress. By the end, you’ll not only understand how to use a calculator effectively but also feel confident about taking control of your financial future. Let’s dive in!

Why Pay Off Your Auto Loan Early?

Paying off an auto loan early comes with numerous advantages. Here are some of the top reasons:

Key Takeaways:

- Save on Interest: The faster you pay, the less interest you’ll accrue.

- Improve Credit Utilization: Lower debt positively impacts your credit score.

- Increase Cash Flow: Freeing up monthly payments can be used for investments or savings.

- Peace of Mind: Eliminating debt provides financial security.

Advantages at a Glance:

| Benefits | Details |

|---|---|

| Save Interest | Cut down the total interest paid over time. |

| Reduce Financial Stress | Gain financial freedom sooner. |

| Improve Loan-to-Value Ratio | Your car equity increases faster. |

| Flexible Cash Flow | Redirect payments to other priorities. |

What is an Auto Loan Early Payoff Calculator?

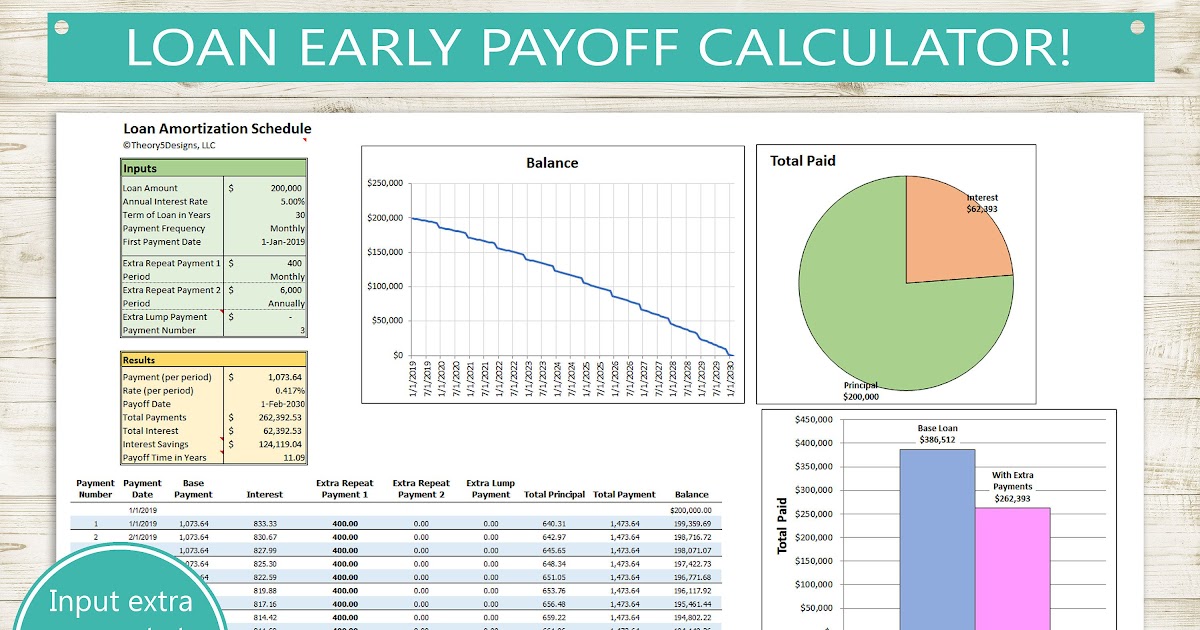

An auto loan early payoff calculator is a tool that estimates how much time and money you can save by making additional payments toward your car loan. By inputting details like loan balance, interest rate, and extra payment amounts, you can visualize the impact of paying ahead.

Features of the Calculator:

- Total Interest Savings: Calculates how much you’ll save.

- New Payoff Date: Displays when the loan will be fully repaid.

- Payment Flexibility: Adjusts scenarios based on extra payments.

How to Use an Auto Loan Early Payoff Calculator

Using a calculator is simple and effective. Follow these steps:

Step 1: Gather Loan Details

- Current loan balance

- Interest rate

- Remaining loan term

- Monthly payment amount

Step 2: Input Extra Payment Amounts

Enter the amount you’re planning to pay additionally, whether monthly, yearly, or as a lump sum.

Step 3: Analyze Results

- Check the new payoff date.

- View the total savings in interest.

- Adjust inputs to test different scenarios.

Example:

If you’re paying $300 monthly on a $15,000 loan with a 5% interest rate and add $50 extra per month, you could save $700 in interest and pay off the loan 8 months earlier.

Real-Life Case Study

Meet Sarah:

Sarah had a $20,000 car loan with a 6% interest rate over five years. After two years, she decided to pay an extra $200 monthly.

Results:

- Saved $2,000 in interest

- Paid off her loan 18 months early

- Used the savings to fund a dream vacation

Tips for Paying Off Your Auto Loan Early

1. Round-Up Payments

Instead of paying $275, round it up to $300. These small increments add up.

2. Make Biweekly Payments

Splitting your monthly payment in two means an extra payment each year.

3. Apply Windfalls

Use bonuses, tax refunds, or extra income to pay down your loan.

4. Avoid Skipping Payments

Even if your lender offers the option, skipping payments increases overall costs.

5. Use an Auto Loan Early Payoff Calculator

Track progress and refine your repayment strategy.

Understanding Potential Downsides

While early payoff is beneficial, there are a few things to consider:

1. Prepayment penalties:

Some lenders charge fees for paying off loans early.

2. Opportunity Cost:

Ensure the extra funds aren’t better used elsewhere, like high-yield investments.

3. Cash Flow Impact:

Make sure extra payments don’t strain your finances.

Comparison Table: Standard vs. Early Payoff

| Criteria | Standard Payment | Early Payoff |

| Loan Term | Full term (e.g., 5 years) | Reduced (e.g., 3.5 years) |

| Interest Paid | Higher | Lower |

| Monthly Payment | Fixed | Increased slightly |

| Financial Flexibility | Later | Sooner |

Frequently Asked Questions

1. What’s the best way to pay off my car loan early?

Use a combination of extra payments, biweekly schedules, and windfalls while avoiding prepayment penalties.

2. Are auto loan early payoff calculators free?

Yes, most online tools are free and easy to use.

3. How much can I save with an early payoff?

Savings depend on loan size, interest rate, and extra payment amounts. Use a calculator to estimate.

4. Will paying off my car loan early hurt my credit score?

It might cause a temporary dip due to changes in credit mix but improves overall financial health.

Final Thoughts: Take the First Step Today

Picture yourself debt-free, with extra cash to invest in your dreams. Paying off your auto loan early isn’t just about saving money—it’s about gaining financial freedom and peace of mind. Use an auto loan early payoff calculator today to map your journey.

If this article inspired you, share it with friends or leave a comment below. Let’s drive toward financial freedom together!